Federal Reserve:Meetings/2024 June 12

Results

- Fed left its benchmark funds rate unchanged at 5.25% to 5.50% as was largely expected while pointing out that there has been some progress in the fight against inflation in recent months, a statement that differed from the previous statement that said there was lack of further progress.

“Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective,” the statement notes.

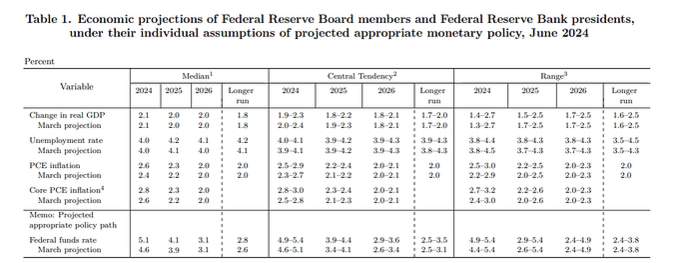

- In their “dot plot” projections, the committee now projects fed funds rate benchmark at 4.1% at the end of 2025, up 0.2% from the March outlook.

- The committee now see four cuts next year versus three projected in March.

- For 2024, the committee signaled just one rate cut instead of the three cuts projected in March.

Notes from Powell:

- Very low PCE readings in the second half of 2023 will not allow for great numbers in the second half of 2024, not much improvement in Y/Y for the rest of the year.

- 1 or 2 is plausible, the committee sees it as multiple scenarios and is data dependent, and could change at any time.

- Today’s report adds to building confidence, but it is not definite. It comes after a few not-so-good reports.

- Gradually rebalancing strong labor market, still do not see anything more than that despite the softening

- No official has another hike into their base case

- Improvement in inflation has been a combination of supply distortions alleviating and demand until when this will continue is unclear

- Shelter rents will come down more slowly than originally though because of the internal dynamic of existing rents.

- Not waiting for anything to break to then react.