Housing Market: Germany

National Level

Supply

The housing shortage in Germany is blatant. From the federal government's perspective, around 400,000 new apartments are needed to combat this situation. Because in the current situation, affordable housing remains expensive. The housing shortage is particularly precarious in many large German cities, but a housing shortage has also been evident in small towns for a long time.[1]

A study commissioned by the alliance by the Pestel Institute and the building research institute ARGE comes to the conclusion that there is a risk of a record housing shortage in 2023. There was a shortage of over 700,000 apartments. This is the largest housing deficit in more than 20 years.

An alliance of tenants' association and construction union as well as social and industry associations has called on the federal and state governments to raise 50 billion euros for the social housing market by 2025.This is the only way to achieve the federal government 's goal of creating 400,000 social housing units in this election period , explained the alliance in Berlin.[2]

Building Permits Federal Statistical Office

The number of building permits allows an early assessment of future construction activity.

May 2024

- May 2024, the construction of 17,800 apartments was approved in Germany. According to the Federal Statistical Office (Destatis), this was 24.2% or 5,700 building permits fewer than in May 2023. Compared to May 2022, the number of building permits even fell by 43.9% or 13,900 apartments. From January to May 2024, 89,000 apartments were approved. That was 21.5% or 24,400 apartments fewer than in the same period last year. [3]

- A total of 14,100 apartments were approved for new residential buildings in May 2024. This was 25.9% or 5,000 apartments fewer than in the same month last year. From January to May 2024, 71,400 new apartments were approved, 24.0% or 22,600 apartments fewer than in the same period last year.

- The number of building permits for single-family homes fell by 31.5% (-7,100) to 15,500. For two-family homes, the number of approved apartments fell by 15.7% (-1,000) to 5,500. The number of approved apartments also fell significantly in the numerically largest building type, multi-family homes, by 21.7% (-13,300) to 47,900 apartments.

2023

- The number of approved apartments fell by 94,100 compared to the previous year to 260,100 apartments, the lowest level since 2012[4]

- In 2023, 214,100 apartments were approved in newly built residential buildings. That was 29.7% or 90,200 new apartments fewer than in the previous year.

- 42.2% fewer residential construction projects by private individuals and 20.3% fewer by companies than in the previous year - particularly strong declines in single- and two-family homes

- Significant declines also occurred in non-residential buildings: a total of 15.7% less converted space than in the previous year, a decline of 20.9% in office and administrative buildings

- Looking at building types, the number of building permits for single-family houses (-39.1% or -30,500 to 47,600) and two-family houses (-48.3% or -13,400 to 14,300 apartments) fell particularly sharply in 2023. These two types of buildings are generally constructed by private individuals

- Around two thirds of new apartments in Germany are being built in apartment buildings, which are predominantly built by companies. Here the number of building permits fell by 25.1% or 47,800 to 142,600 apartments.

Construction completions

Forecasts

By 2026, Europe will have finished building only about 1.5 million housing units (down 13% on 2023). For Germany, that means an expected decline of 35%. [5]

“Due in particular to the sharp rise in construction and financing costs, it’s often no longer possible to build new homes in Germany. Politicians haven’t yet made a decisive improvement to the policy framework,” says ifo construction expert Ludwig Dorffmeister. “The resulting decline in the number of permits doesn’t bode well for the coming years.””

PNB Paribas

The significant decline in the number of building permits issued indicates a slowdown in residential construction until at least 2027.

- We expect to see a significant drop in the number of residential building permits (260,000) and completions (240,000) in 2023 (final figures were not available at the time of this report). According to our calculations, the number of building permits is likely to drop further to around 200,000 residential units as of 2024.

- Building completions will respond with a delay. Based on the number of building permits issued, we expect to see a decline in completions from around 200,000 (2024) to 160,000 (2026) before the market stabilises again. It is unlikely that the federal government’s target of 400,000 completed units per year will be met.

- The Pestel Institute anticipates an annual need for new construction of between 360,000 and 410,000 units based on the current deficit and the need to replace obsolete properties. Based on estimated completion figures, this means that only 59% of demand for new housing will be met in 2023. This share is likely to fall to 44% by 2027 due to the drop in completion numbers.

- This data does not take into account pent-up demand from 2023. For 2022/2023, the current construction deficit is estimated at around between 350,000 (ZIA) and 700,000 units (Pestel Institute). When we add this to the projected annual shortfall in new construction, the construction deficit could grow to over 1 million units by 2027

Demand

Transaction Volume

Q1 2024

In the first quarter of 2024, residential properties in Germany were traded for around €755m (transactions of at least 50 units). This was around 60% less than the quarterly average of the previous year (see Graph below) and even 86% less than the quarterly average of the last five years. [7]

- With fewer than twenty transactions in the first quarter, transaction activity fell to its lowest level since we began recording it in 2009

- Prices continue to receive a tailwind from the very good fundamental data on the letting market from the perspective of landlords and investors. Although the influx of refugees from Ukraine has slowed, net immigration remained high last year. The birth deficit is likely to be more than offset by immigration in the coming years and demand for housing will continue to rise.

- As completion figures are heading towards only 150,000 new residential units per year nationwide, there is currently no sign of an easing on the letting market on the horizon. The consequence is likely to be a further decline in vacancy rates and rising market rents

- Buyers are often regional players who are familiar with the market. It is currently the core segment in which many successful transaction processes can be observed.

- The prime net initial yield for multi-family properties was 3.6% at the end of the first quarter of 2024, remaining stable for the second quarter in a row.

As of February 2024

There were no signs of such a turnaround in February either. We registered a good eighty transactions with a volume of around €1.7bn, roughly the same level as in January. The figures for the first two months of 2024 are also roughly in line with the previous year's figures. Transaction activity appears to have bottomed out, but is probably not yet to increase. We are still not observing any significant increase in the number of transaction processes. In addition, some processes are still being cancelled and do not result in a sale because the landlord's target price has not been reached.[9]

Forecats

C&W assumes stabilization. Colliers believes a total turnover of ten billion euros is possible. JLL expects a moderate increase in transaction volume to a range between nine and eleven billion euros. CBRE expects the residential transaction market to pick up with an investment volume of around eight billion euros.[10]

Vacancy Rate

The vacancy rate in all of Germany’s top 7 cities is well below the 3% mark, which is considered the minimum fluctuation reserve for a functioning housing market. Prices in a very tight rental housing market are likely to continue to be driven by persistently high pressure from demand and a lack of relief supply side due to sluggish construction activity.

2022

Market-active vacancy in Germany has fallen significantly over the past 10 years in line with ongoing high population growth. The period between 2021 and 2022 saw the sharpest decline of 0.3 percentage points.

- The CBRE-empirica Vacancy Index fell across all regions for the first time between 2021 and 2022. This is mainly due to relatively widespread housing demand from Ukrainian refugees.

- Pressure on residential rents is likely to increase considerably against the backdrop of a significant drop in market-active vacancy.

Deliquencies

his statistic shows the proportion of the population in Germany in households with arrears on mortgage or rent payments in the period from 2008 to 2022. It shows the proportion of the population as a whole and that of the population at risk of poverty². In 2022, the proportion of the population in Germany in households in arrears on mortgage or rent payments was around 2.1 percent.[11]

Fitch 2023

- However, German borrowers who have refinanced recently have responded to higher mortgage rates by re-fixing for shorter periods and reducing their amortisation rates, mirroring efforts in new mortgage lending to maintain or improve mortgage serviceability. Assuming that these adjustments by borrowers persist in 2024, and taking into account typical loan amortisation so far, monthly due amounts after refinancing next year should remain broadly unchanged for an average German mortgage originated in 2012-2013.[12]

- Data from Europace indicates that the share of mortgages with fixed terms of five years or less is very low, and decreased from 2018, so only a small proportion of refinancing borrowers in 2024-2025 should be affected.

- German households’ nominal disposable incomes have increased by about 50% since 2012, and we expect positive real wage growth in 2024 and low unemployment to support mortgage loan serviceability. We therefore expect broadly stable mortgage performance, and forecast delinquency rates to rise to 0.5% in 2024 from 0.4% in 2023, before reverting to slightly lower levels in 2025. We expect 10-year fixed mortgage rates to decline slightly from 4% this year to 3.75% in 2024 and 3.5% in 2025.

Prices

Federal Statistical Office House Price Index

| Price indices for residential properties

in Germany | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Subject of evidence[13] | Unit | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| House Price Index | 2015=100 | 84.4 | 84.4 | 83.3 | 83.6 | 82.3 | 83.3 | 83.0 | 81.2 | 82.3 | 83.0 | 83.9 | 86.8 | 89.8 | 92.6 | 95.5 | 100.0 | 107.5 | 114.1 | 121.7 | 128.7 | 138.7 | 154.7 | 162.9 | 149.2p |

| Newly Built Residential Properties | 2015=100 | 76.3 | 74.8 | 74.4 | 74.3 | 74.7 | 74.6 | 73.9 | 75.4 | 77.4 | 81.6 | 83.6 | 87.8 | 90.3 | 91.4 | 94.8 | 100.0 | 106.9 | 111.8 | 118.9 | 122.9 | 130.4 | 140.0 | 148.1 | 144.8p |

| Existing Residential Properties | 2015=100 | 85.8 | 86.2 | 84.8 | 85.3 | 83.6 | 84.9 | 84.6 | 82.2 | 83.2 | 83.2 | 83.9 | 86.7 | 89.7 | 92.8 | 95.6 | 100.0 | 107.6 | 114.5 | 122.2 | 129.8 | 140.2 | 157.5 | 165.7 | 150.0p |

| Price Index for Building Land | 2015=100 | 69.9 | 71.0 | 71.9 | 72.9 | 73.7 | 74.6 | 76.1 | 76.2 | 76.2 | 76.6 | 78.1 | 80.2 | 82.8 | 87.9 | 93.4 | 100.0 | 110.0 | 122.7 | 134.5 | 146.1 | 156.1 | 187.5p | . | . |

Q4 2023

On average in 2023, residential property prices fell by 8.4% compared to 2022. This was the largest year-on-year decline since the time series began in 2000 and the first decline since 2007. In the years from 2008 to 2022 Residential property prices have risen continuously on average over the year.[14]

- At -7.8%, the prices for existing properties fell more sharply than the prices for new buildings (-3.2%) compared to the same quarter of the previous year.

- The prices for one- and two-family homes in the top 7 metropolises (Berlin, Hamburg, Munich, Cologne, Frankfurt am Main, Stuttgart and Düsseldorf) fell by an average of 9.1% compared to the 4th quarter of 2022, condominiums cost 5.8 % fewer

EPX Index

The EPX hedonic is based on transaction data from private real estate financing from the independent Europace platform. Around 20 percent of all real estate financing for private customers in Germany is processed via Europace. The EPX was developed in 2005 together with the Federal Office for Building and Regional Planning BBR and has been collected monthly since then. [15]

Q2 2024

- In June, prices for condominiums rose by 0.78 percent and the index reached 210.96 points. In the same period last year, prices rose by 0.55 percent - the first positive development since October 2022. [16]

- In the segment of existing single- and two-family homes, prices remained stable in June with a minimal price decline of 0.08 percent. The index fell to 193.38 index points. Over the last 12 months, prices fell by 1.56 percent.

- The costs for new buildings also fell only minimally in June by 0.12 percent and the house price index is at 234.56 points. Compared to the previous year, prices rose by 2.62 percent.

- Overall, the overall index remains stable with a slight increase of 0.19 percent. The index reached 212.97 points. Compared to the same period last year, prices increased by 0.64 percent for the first time in months.

“ The prices for condominiums continue to rise, while real estate prices for existing houses and new buildings remain stable with minimal price declines ,” explains Stefan Münter, Co-CEO and board member of Europace, explaining the house price index. “ The bottom has long been reached and we continue to see a clearly high demand for real estate. We expect prices to rise in the coming months and see a slow shift from a buyer’s market to a seller’s market. The feasibility is unlikely to improve and the supply will decrease again in the future. It is therefore essential to keep a close eye on the economic conditions and to react flexibly to changes ,” adds Münter.

" The current data clearly show that the price decline on the German housing market is over, but it also shows that there is still headwind in the price regatta ," says Sebastian Hein, Director of Market Data at VALUE Ag, analyzing the current figures. " The rental markets have also taken a breather, which only seems to indicate an easing after the extreme dynamics of the last few quarters. The rental supply is continuing to decline and moving is therefore becoming more difficult even without new price impulses ," he continues.

Q1 2024

In March, the Europace house price index (EPX) illustrates a turning point with rising real estate prices in all segments. The overall index increases by 0.60 percent.[17]

- The condominium segment recorded an increase of 0.79 percent in March. The house price index rises to 204.40 index points. Compared to the previous year, prices fell by 2.55 percent.

- In March, the costs for existing one- and two-family homes increased by 0.80 percent and the index reached 192.24 points. Over the last twelve months, prices fell by 3.57 percent.

- New building prices also became more expensive, so that the house price index ended up at 236.17 points with an increase of 0.28 percent. In the same period last year, prices rose by 1.47 percent.

Q4 2023

According to the EPX mean index from the real estate transaction platform Europace, a newly built house (approx. 130 m² of living space, approx. 450 m² of land) cost an average of 567,606 euros in February 2024. For existing houses (built in 1983, approx. 120 m² of living space and approx. 425 m² of land) the average purchase price was 354,863 euros, for condominiums (built in 1985, approx. 83 m² of living space) it was 265,816 euros.[18]

The overall index recorded its absolute peak in June 2022 with an index value of 224.87. Since then, underlying property prices and therefore the index have declined slightly. However, the price increase only continues for newly built houses and the other segments also stabilized in spring 2023.

Q3 2023

On average, the price of apartments fell by -10.9% compared to the same quarter last year, while the price for houses fell by -7.8%.

| Aparment Prices[19] | Single- and two-family houses | ||||

|---|---|---|---|---|---|

| Location | Median price in €/m² | Median price for 90 m² apartment | Location | Median price in €/m² | Median price for 150 m² house |

| Munich | 7,119 €/m² | €640,710 | Munich | 6,027 €/m² | €904,050 |

| Berlin | 5,154 €/m² | €463,860 | Stuttgart | 4,107 €/m² | €616,050 |

| Hamburg | 4,495 €/m² | €404,550 | Berlin | 3,900 €/m² | €585,000 |

| Stuttgart | 3,911 €/m² | €351,990 | Hamburg | 3,554 €/m² | €533,100 |

| Frankfurt | 3,857 €/m² | €347,130 | Frankfurt | 3,504 €/m² | €525,600 |

| Cologne | 3,531 €/m² | €317,790 | Cologne | 3,125 €/m² | €468,750 |

| Dusseldorf | 3,495 €/m² | €314,550 | Dresden | 3,100 €/m² | €465,000 |

| Dresden | 2,979 €/m² | €268,110 | Dusseldorf | 3,082 €/m² | €462,300 |

| Hanover | 2,822 €/m² | €253,980 | Dortmund | 2,715 €/m² | €407,250 |

| Dortmund | 2,174 €/m² | €195,660 | Hanover | 2,601 €/m² | €390,150 |

Forecasts 2024

Schwäbisch Hall real estate expert Oliver Adler. (Source: Bausparkasse Schwäbisch Hall AG):

My personal opinion is that in 2024 we will be in calmer waters for the residential real estate market overall.[20]

- Thesis 1: The price decline will continue in 2024. We have not yet reached the bottom of pricing. Particularly for older properties with a lack of energy-related modernization, some experts expect, on average, a further price decline of 5 to 10 percent. Smaller price discounts can be expected for newer, more energy-efficient buildings. However, since significantly fewer new properties will come onto the market, the discounts on used properties will shape the average value.

- Thesis 2: In 2024, real estate prices will only fall slightly. The experts at DZ Bank expect a range between -0.5 and -2.5 percent. They also assume that negative characteristics, such as poor location or poor energy efficiency, will depress the price structure of real estate. But: If building interest rates fall faster than expected, this could cause property prices to rise again.

- Thesis 3: We have a large, but difficult to quantify, potential of potential real estate buyers who have put their plans on hold since the rise in interest rates and are exploring the market. From 2024 onwards, they will increasingly appear as buyers and may build more new ones again because construction capacity will be freed up. The German Economic Institute in Cologne therefore sees higher real estate prices again from 2024. Another reason is the increased rental prices - by a total of 3 percent in 2023. According to DIW, they will continue to rise, solely due to the increasing total population. This makes housing more expensive for everyone, for buyers and tenants.

DR.Klein (March 6,2024):

There will be no nationwide decline in real estate prices in the first half of 2024. How real estate prices develop depends primarily on the location and condition of the property.[21]

- In the large metropolitan regions, real estate prices remain stable or only fall slightly.

- In the surrounding area, real estate prices are falling slightly in the single-digit percentage range.

- In contrast, real estate prices in rural and structurally weak regions should fall significantly in the first half of 2024. Price drops of around 10 to 15% are possible.

- Existing properties that require a lot of renovation or have a poor energy balance also become cheaper. In particular, properties in energy efficiency classes G and H will also lose value in the first half of 2024.

PREA (February 27, 2024):

For the study, analysts examined real estate market cycles in 24 countries from 1975 to 2024 and applied the data to the current situation in the German residential property market.

Anticipate, prices will fall back to the level of early 2017 by the end of this year. Compared to the first quarter of 2022, this would correspond to an inflation-adjusted price correction of 25 percent (an additional 4-5% decline expected). Afterwards, the market will either enter a recovery phase or the price correction will continue at a slower pace.[22]

- Although prices for residential properties in Germany have already fallen by 21 percent between the first quarter of 2022 and the third quarter of 2023, the bottom has not yet been reached. The saying 'Survive until 25' is likely to become a reality for many market participants.

- PREA analysis confirms that there is a positive correlation between the duration and dynamics of upswings and downturns. This means: if property prices have risen sharply over a long period, this was usually followed by a long phase of significantly falling prices. Therefore, the current downturn in the German residential property market is still too short and too mild.

- The opportunity costs for real estate investment have drastically increased with the turn in interest rates. While real estate as an investment was almost without competition for more than a decade, the residential property market is now competing again with other forms of investment such as stocks and government bonds

- Even upper-middle-class households with a monthly income of 5,000 euros or more can only afford a larger existing apartment in the top-7 cities if they spend up to 50% of their monthly net household income on financing.

- Furthermore, the supply in the German residential real estate market is likely to increase soon. The reason: With higher interest rates, the costs for refinancing have also risen. By 2025 at the latest, many owners will need to refinance the loans they took out ten years earlier under favorable conditions

- For investors,due to the turn in interest rates, not only have their financing costs increased. At the same time, the value of the mortgaged properties and thus the value of the securities have decreased. This limits their borrowing capacity and reduces their liquidity. Thus, they may be forced to reduce their holdings

- However, in many major cities, especially the top 7, the decline in prices may be less severe. A significant reason is the sharp increase in rents in recent years

Long Term Forecats

PostBank

| City[23] | Price trend |

|---|---|

| Munich | 2.08% |

| Frankfurt a. M | 1.93% |

| Cologne | 1.52% |

| Berlin | 1.24% |

| Stuttgart | 1.03% |

| Dusseldorf | 0.76% |

| Hamburg | 0.29% |

DR.Klein

In Germany, demand for real estate continues to be higher than supply. Accordingly, real estate prices will rise in the long term. Specifically, there are 4 points why property prices are not falling significantly despite currently high building interest rates.[24]

- Dream of owning your own home: Many Germans still want to own their own property. According to a current representative survey by Dr. Small 92% of 18-29 year olds will own home at some point.

- Slow construction pace: Construction is going on in Germany, but too slowly. The new apartments and houses are not enough to satisfy the need for space.

- Scarce resources and skilled workers: With the disruption of delivery routes during the pandemic, important building materials have either become more expensive or are difficult to obtain. There is also a lack of skilled workers on German construction sites, which is further slowing down the pace of construction.

- Increased demand due to labor migration: After the end of the pandemic, more foreign workers will come to Germany again. This continues to drive demand for real estate upwards.

Rents

According to Colliers, in the A cities, the asking rents for existing apartments rose by around eight percent, and in the new building segment by more than nine percent - if you look at Germany as a whole, new rental rents for existing apartments rose by five percent and new building rents by seven percent.[25]

BNP Paribas

2023

High pressure from demand, which was further exacerbated by the impact of Ukrainian refugees, the shift in demand away from the condominium market and insufficient new-build construction caused rents to rise.

- While asking rents for existing properties in student cities as well as in large and medium-sized cities rose +4% compared to 2022, rental growth in Germany’s A-cities was even more dynamic with a median rent increase of +7%.

- A-cities led the pack with a median asking rent of €15.15 per sqm. The gap to the other city categories remained in the typical range.

Forecast

Colliers:

Due to the massive decline in new construction and the growing shortage of supply, Colliers also expects rents to rise significantly in all segments in 2024.[26]

JLL:

According to JLL, the current hesitant demand for home ownership will lead to additional demand for rental apartments - which will exacerbate the dynamic in rents.

Berlin

Supply

Deficit of just under 27,000 units in 2023 alone.

Demand

Transaction Volume

Vacancy Rate

Prices

GUTHMAN

Q3 2024

| Period | Existing buildingsMedian Offer price | Index (base 10 years = 100) | New buildingsMedian Offer price | Index (base 10 years = 100) |

|---|---|---|---|---|

| Current quarter | 5,380 EUR/m² | - | 8,450 EUR/m² | - |

| 1 Year | 5,450 EUR/m² | -1.30% | 8,160 EUR/m² | 3.50% |

| 3 Years | 5,150 EUR/m² | 4.50% | 7,940 EUR/m² | 6.40% |

| 5 Years | 4,610 EUR/m² | 16.80% | 6,380 EUR/m² | 32.50% |

| 10 Years | 2,570 EUR/m² | 109.20% | 3,750 EUR/m² | 125.60% |

Q1 2024

After nearly 20 months of downturn, the situation is divided. In 11 districts, trends are turning positive, but the outlook remains unclear in the other 11 older districts. As of , the development over the past twelve months stands at percent. Shorter observation periods reveal a shallower price decline, with a slight increase of over the last three months.[27]

- Recent sales, previously down by 21 percent, are picking up again. Buyers are taking advantage of the low prices to secure profitable deals. Despite an average marketing period of 21 weeks, high-end lofts and penthouses are slower to sell compared to apartments.

| Period | Existing buildingsMedian Offer price | Index (base 10 years = 100) | New buildingsMedian Offer price | Index (base 10 years = 100) |

| Current quarter | 5,350 EUR/m² | - | 8,300 EUR/m² | - |

| 1 Year | 5,520 EUR/m² | -3.10% | 8,560 EUR/m² | -3.10% |

| 3 Years | 5,110 EUR/m² | 4.80% | 7,000 EUR/m² | 18.60% |

| 5 Years | 4,340 EUR/m² | 23.30% | 6,160 EUR/m² | 34.80% |

| 10 Years | 2,500 EUR/m² | 114.10% | 3,620 EUR/m² | 129.50% |

Existing Properties

| Certified Average Values for Existing Properties in 2022 and 2023 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| District | Mitte | Friedrichshain-Kreuzberg | Pankow | Charlottenburg-Wilmersdorf | Spandau | Steglitz-Zehlendorf | Tempelhof-Schöneberg | Neukölln | Treptow-Köpenick | Marzahn-Hellersdorf | Lichtenberg | Reinickendorf | Berlin |

| 2022 Average Sale Price EUR/m² | 5.976 | 6.024 | 5.933 | 6.169 | 3.595 | 5.092 | 4.917 | 4.923 | 4.231 | 3.733 | 4.403 | 4.128 | 5.344 |

| 2023 Average Sale Price EUR/m² | 5.844 | 5.844 | 5.623 | 5.906 | 3.457 | 4.793 | 4.699 | 4.653 | 4.179 | 3.503 | 4.382 | 3.994 | 5.105 |

| Difference | -2% | -3% | -5% | -4% | -4% | -6% | -4% | -5% | -1% | -6% | 0% | -3% | -4% |

| 2022 No.Transactions | 1.258 | 1.266 | 1.238 | 1.565 | 464 | 1.037 | 1.239 | 748 | 551 | 142 | 317 | 512 | 10.337 |

| 2023 No.Transactions | 974 | 1.044 | 884 | 1.144 | 390 | 797 | 931 | 661 | 447 | 108 | 307 | 436 | 8.123 |

| Difference | -23% | -18% | -29% | -27% | -16% | -23% | -25% | -12% | -19% | -24% | -3% | -15% | -21% |

New Properties

While 2,063 new units were sold in 2022, only 1,029 apartments from ongoing projects were sold last year, 2023. However, in the current year of 2024, we have already counted approximately 280 new apartment offers in the first quarter, suggesting a potential recovery in the segment

| Certified Average Values for New Construction Properties in 2022 and 2023 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| District | Mitte | Friedrichshain-Kreuzberg | Pankow | Charlottenburg-Wilmersdorf | Spandau | Steglitz-Zehlendorf | Tempelhof-Schöneberg | Neukölln | Treptow-Köpenick | Marzahn-Hellersdorf | Lichtenberg | Reinickendorf | Berlin |

| 2022 Average Sales Prices EUR/m² | 10.764 | 8.908 | 7.231 | 9.873 | 6.561 | 7.782 | 8.97 | 7.318 | 8.043 | 5.24 | 6.399 | 7.069 | 7.922 |

| 2023 AverageSales Prices EUR/m² | 10.329 | 9.872 | 7.027 | 11.297 | 6.364 | 9.030 | 7.437 | 5.687 | 8.435 | 4.84 | 6.132 | 6.096 | 7.919 |

| Difference | -4% | 11% | -3% | 14% | -3% | 16% | -17% | -22% | 5% | -8% | -4% | -14% | 0% |

| 2022 No. Transactions | 108 | 205 | 362 | 153 | 126 | 52 | 216 | 7 | 465 | 115 | 198 | 56 | 2.063 |

| 2023 No. Transactions | 52 | 124 | 123 | 43 | 69 | 32 | 83 | 8 | 290 | 42 | 111 | 52 | 1.029 |

| Difference | -52% | -40% | -66% | -72% | -45% | -38% | -62% | 14% | -38% | -63% | -44% | -7% | -50% |

Building Blocks

The apartment block market in the capital is also gaining momentum. In the first quarter of 2024, the number of listings and closings increased, with both multipliers and square meter prices dropping.[28]

| Year | No. Transactions | Average EUR/m² Living Area | Difference to Previous Year |

|---|---|---|---|

| 2018 | 990 | 2.643 | |

| 2019 | 855 | 2.861 | 8% |

| 2020 | 873 | 2.73 | -5% |

| 2021 | 914 | 3.11 | 14% |

| 2022 | 751 | 3.178 | 2% |

| 2023 | 599 | 2.673 | -16% |

| Average Sales Prices per SQM Living Area | |||

|---|---|---|---|

| District | 2022 EUR/m² | 2023 EUR/m² | Difference % |

| Mitte | 5308 | 3864 | -27 |

| Tiergarten | 2745 | 1709 | -38 |

| Wedding | 2660 | 2043 | -23 |

| Prenzlauer Berg | 3551 | 2481 | -30 |

| Friedrichshain | 2824 | 2448 | -13 |

| Kreuzberg | 3058 | 2455 | -20 |

| Charlottenburg | 3769 | 3379 | -10 |

| Spandau | 2943 | 2275 | -23 |

| Wilmersdorf | 3778 | 3894 | 3 |

| Schöneberg | 3133 | 2626 | -16 |

| Steglitz | 3242 | 2393 | -26 |

| Tempelhof | 3201 | 2155 | -33 |

| Neukölln | 2484 | 2275 | -8 |

| Köpenick | 3162 | 3263 | 3 |

| Lichtenberg | 3659 | 2300 | -37 |

| Weißensee | 2987 | 3224 | 8 |

| Pankow | 3284 | 2930 | -11 |

| Reinickendorf | 2771 | 2615 | -6 |

| Marzahn | 2985 | 3180 | 7 |

| Hohenschönhausen | 2213 | 2460 | 11 |

| Hellersdorf | 3266 | 2389 | -27 |

| Berlin (total) | 3178 | 2673 | -16 |

Rhe spread usually depends on the year of construction and state of maintenance as well as investment requirements. Recently, residential buildings from the post-war years in particular have lost value due to their poor energy balance. The effect has been fuelled by a long period of unclear legislation and the difficulty of calculating the costs of energy-efficient redevelopment. The downturn in the construction of new buildings has recently led to a decline in modernisation and refurbishment costs

| Jahr / Year | Mitte | Tiergarten | Wedding | Prenzlauer Berg | Friedrichshain | Kreuzberg | Charlottenburg | Spandau | Wilmersdorf | Zehlendorf | Schöneberg | Steglitz | Tempelhof | Neukölln | Treptow | Köpenick | Lichtenberg | Weißensee | Pankow | Reinickendorf | Marzahn | Hohenschönhausen | Hellersdorf |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018 | 1.267 bis 5.247 | 1.255 bis 4.447 | 950 bis 3.004 | 1.582 bis 3.510 | 888 bis 5.793 | 1.165 bis 5.655 | 1.350 bis 6.401 | 301 bis 11.919 | 1.048 bis 5.366 | 1.526 bis 7.453 | 1.068 bis 3.089 | 1.065 bis 3.687 | 983 bis 2.817 | 695 bis 4.849 | 1.062 bis 3.873 | 1.081 bis 2.066 | 844 bis 4.840 | 805 bis 2.379 | 468 bis 4.652 | 570 bis 5.695 | 1.350 bis 2.959 | 500 bis 2.097 | 857 bis 2.320 |

| 2019 | 1.208 bis 6.168 | 1.425 bis 3.647 | 874 bis 3.154 | 1.461 bis 4.964 | 1.395 bis 3.404 | 1.082 bis 4.197 | 1.423 bis 11.340 | 606 bis 3.192 | 1.601 bis 9.143 | 2.446 bis 5.173 | 1.314 bis 3.917 | 1.164 bis 4.071 | 862 bis 5.997 | 1.032 bis 2.941 | 1.318 bis 2.656 | 1.579 bis 2.650 | 698 bis 4.630 | 1.000 bis 3.376 | 671 bis 3.090 | 396 bis 4.839 | 1.018 bis 2.339 | 1.382 bis 2.028 | 846 bis 3.858 |

| 2020 | 1.594 bis 8.481 | 1.454 bis 2.811 | 1.003 bis 4.084 | 1.310 bis 3.280 | 1.248 bis 3.284 | 1.424 bis 4.894 | 1.364 bis 6.181 | 431 bis 5.758 | 1.151 bis 10.526 | 3.230 bis 4.837 | 1.363 bis 4.841 | 1.637 bis 3.183 | 770 bis 4.909 | 592 bis 4.392 | 986 bis 4.069 | 930 bis 5.683 | 1.230 bis 5.748 | 1.126 bis 4.594 | 895 bis 2.819 | 654 bis 5.248 | 1.589 bis 3.255 | 1.729 bis 2.307 | 1.495 bis 3.090 |

| 2021 | 1.603 bis 8.475 | 1.106 bis 3.422 | 841 bis 5.446 | 1.436 bis 6.835 | 1.314 bis 6.696 | 1.167 bis 4.264 | 1.570 bis 16.262 | 841 bis 4.633 | 1.596 bis 7.347 | 2.560 bis 6.944 | 1.625 bis 7.047 | 1.489 bis 5.253 | 1.125 bis 4.644 | 896 bis 6.326 | 1.794 bis 5.217 | 984 bis 5.812 | 1.142 bis 4.960 | 1.390 bis 3.167 | 1.109 bis 6.111 | 601 bis 3.873 | 2.006 bis 3.012 | 1.525 bis 4.482 | 1.248 bis 3.389 |

| 2022 | 1.489 bis 16.844 | 1.193 bis 3.702 | 1.358 bis 3.867 | 347 bis 7.736 | 458 bis 3.141 | 862 bis 5.068 | 1.707 bis 6.579 | 472 bis 6.013 | 874 bis 7.043 | 1.976 bis 3.897 | 1.735 bis 4.707 | 1.799 bis 3.821 | 1.232 bis 3.670 | 824 bis 4.515 | 1.467 bis 2.931 | 1.716 bis 3.999 | 287 bis 6.116 | 1.691 bis 3.186 | 1.421 bis 5.626 | 954 bis 5.094 | 2.195 bis 2.733 | 1.081 bis 2.150 | 1.717 bis 4.312 |

| 2023 | 1.495 bis 5.777 | 660 bis 1.823 | 446 bis 2.594 | 994 bis 2.964 | 1.374 bis 2.844 | 911 bis 6.567 | 1.093 bis 7.927 | 800 bis 4.608 | 1.466 bis 6.024 | - | 1.339 bis 4.404 | 1.827 bis 2.082 | 1.069 bis 2.570 | 756 bis 5.590 | - | 2.302 bis 2.912 | 357 bis 3.134 | 1.247 bis 5.177 | 950 bis 4.509 | 866 bis 4.270 | 1.266 bis 4.667 | 1.138 bis 2.714 | 1.425 bis 2.523 |

| Quelle: Gutachterausschuss Berlin, eigene Anfrage | |||||||||||||||||||||||

ImmoScout24

| Berlin | Germany | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quarter[29] | Apartment | House | Apartment | House | ||||||||

| Price/m2 | Q/Q | Y/Y | Price/m2 | Q/Q | Y/Y | Price/m2 | Q/Q | Y/Y | Price/m2 | Q/Q | Y/Y | |

| Q3 2024 | 4,167 | 0.29% | -1.77% | 4,466 | -0.60% | -4.69% | 2,592 | 1.61% | -0.04% | 3,069 | 1.09% | -0.97% |

| Q2 2024 | 4,155 | 0.41% | -2.81% | 4,493 | 0.51% | -5.65% | 2,551 | 0.00% | -2.63% | 3,036 | -0.20% | -3.07% |

| Q1 2024 | 4,138 | -1.19% | -3.81% | 4,470 | -1.97% | -7.87% | 2,551 | -1.12% | -4.71% | 3,042 | -0.69% | -19.61% |

| Q4 2023 | 4,188 | -1.27% | -3.94% | 4,560 | -2.69% | -10.25% | 2,580 | -0.50% | -6.52% | 3,063 | -1.16% | -6.59% |

| Q3 2023 | 4,242 | -0.77% | -2.88% | 4,686 | -1.60% | -9.05% | 2,593 | -1.03% | -7.26% | 3,099 | -1.05% | -6.37% |

| Q2 2023 | 4,275 | -0.63% | 4,762 | -1.85% | 2,620 | -2.13% | 3,132 | -17.23% | ||||

| Q1 2023 | 4,302 | -1.33% | 4,852 | -4.51% | 2,677 | -3.01% | 3,784 | 15.40% | ||||

| Q4 2022 | 4,360 | -0.18% | 5,081 | -1.38% | 2,760 | -1.29% | 3,279 | -0.94% | ||||

| Q3 2022 | 4,368 | 5,152 | 2,796 | 3,310 | ||||||||

| Q3 2020 | 3,544 | 4,050 | 2,212 | 2,604 | ||||||||

| Q2 2020 | 3,499 | 3,939 | 2,160 | 2,547 | ||||||||

Apartment

| district | Q1 2024 purchase price (€ / m²) | Q3 2024 |

|---|---|---|

| Friedrichshain-Kreuzberg | 5,525 €/m² | 5.565 €/m² |

| Charlottenburg-Wilmersdorf | 5,473 €/m² | 5.486 €/m² |

| Center (district) | 5,288 €/m² | 5.346 €/m² |

| Steglitz-Zehlendorf | 4,863 €/m² | 4.901 €/m² |

| Tempelhof-Schöneberg | 4,179 €/m² | 4.212 €/m² |

| Pankow (district) | 4,147 €/m² | 4.163 €/m² |

| Neukölln (district) | 3,961 €/m² | 3.985 €/m² |

| Reinickendorf (district) | 3,893 €/m² | 3.913 €/m² |

| Lichtenberg (district) | 3,781 €/m² | 3.787 €/m² |

| Treptow-Köpenick | 3,764 €/m² | 3.764 €/m² |

| Spandau (district) | 3,618 €/m² | 3.648 €/m² |

| Marzahn-Hellersdorf | 3,383 €/m² | 3.411 €/m² |

House

| district | Q1 2024 purchase price (€ / m²) | Q3 2024 |

|---|---|---|

| Steglitz-Zehlendorf | 6,193 €/m² | 6,170 €/m² |

| Charlottenburg-Wilmersdorf | 5,561 €/m² | 5,708 €/m² |

| Friedrichshain-Kreuzberg | 5,174 €/m² | 5,147 €/m² |

| Pankow (district) | 4,567 €/m² | 4,571 €/m² |

| Tempelhof-Schöneberg | 4,527 €/m² | 4,504 €/m² |

| Reinickendorf (district) | 4,504 €/m² | 4,498 €/m² |

| Center (district) | 4,464 €/m² | 4,482 €/m² |

| Lichtenberg (district) | 4,158 €/m² | 4,152 €/m² |

| Spandau (district) | 4,035 €/m² | 4,068 €/m² |

| Neukölln (district) | 4,027 €/m² | 4,001 €/m² |

| Marzahn-Hellersdorf | 3,835 €/m² | 3,833 €/m² |

| Treptow-Köpenick | 3,827 €/m² | 3,810 €/m² |

ImmoWelt

Aparments

| Year[30] | average price | Change from previous year |

|---|---|---|

| 2024 | 4,967 €/m² | -0.4% |

| 2023 | 4,986 €/m² | -1.7% |

| 2022 | 5,075 €/m² | -0.6% |

| 2021 | 5,104 €/m² | +14% |

| 2020 | 4,477 €/m² | +8.3% |

| 2019 | 4,134 €/m² | +10.7% |

| 2018 | 3,733 €/m² | +9.8% |

| 2017 | 3,401 €/m² | — |

Houses

| Year[31] | average price | Change from previous year |

|---|---|---|

| 2024 | 4,721 €/m² | +0.4% |

| 2023 | 4,700 €/m² | -9.9% |

| 2022 | 5,214 €/m² | -4.2% |

| 2021 | 5,441 €/m² | +14.3% |

| 2020 | 4,758 €/m² | +10.2% |

| 2019 | 4,317 €/m² | +7.2% |

| 2018 | 4,029 €/m² | +11.3% |

| 2017 | 3,619 €/m² | — |

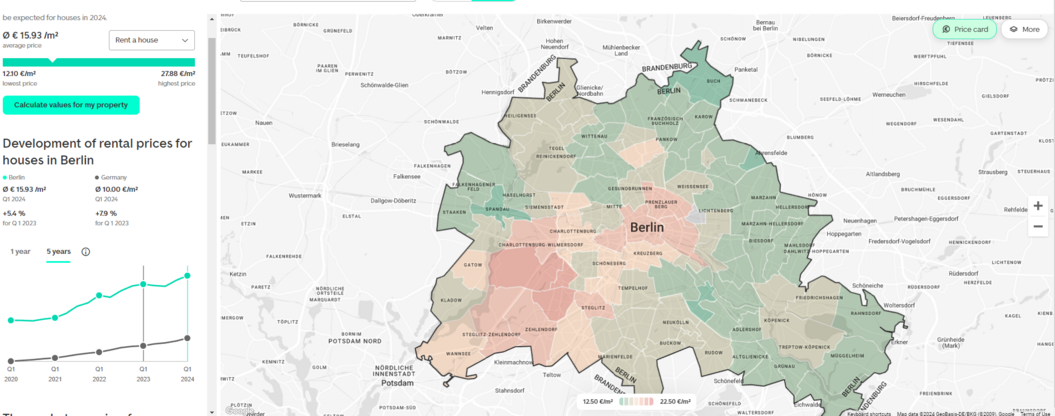

Rents

BNP Paribas

2023

Rents of existing properties rose a significant 21% compared to 2022 and reached the €17 mark for the first time. New-build rents recorded a median value of €21 per sqm.[32]

GUTHMAN

Q3 2024

| Period | Existing buildingsMedian Offer price | Index (base 10 years = 100) | New buildingsMedian Offer price | Index (base 10 years = 100) |

|---|---|---|---|---|

| Current quarter | 15.20 EUR/m² | - | 23.10 EUR/m² | - |

| 1 Year | 14.05 EUR/m² | 8.20% | 23.95 EUR/m² | -3.50% |

| 3 Years | 12.20 EUR/m² | 24.50% | 20.00 EUR/m² | 15.50% |

| 5 Years | 10.95 EUR/m² | 38.60% | 17.10 EUR/m² | 35.00% |

Q1 2024

The rental market situation remains tense. Current market dynamics and the interest rate environment continue to put pressure on the already limited supply. Rising financing costs and higher equity requirements make purchasing a home more expensive, leading to increased demand in the rental sector. [33]

- In the standard rental market below 20 EUR/m², our calculations show the average rent in the current quarter is 13.55 EUR/m² . The increase compared to the same period last year is about 11.5%

- According to this method, there is a total housing deficit of approximately 112,000 units with a decreasing pressure from west to east. Some districts in East Berlin theoretically even have low fluctuation reserves. In the districts of Pankow, Köpenick, and Marzahn-Hellersdorf, the housing market is almost balanced, except for some neighborhoods.

| Period | Existing buildingsMedian Offer price | Index (base 10 years = 100) | New buildingsMedian Offer price | Index (base 10 years = 100) |

|---|---|---|---|---|

| Current quarter | 13.55 EUR/m² | - | 28.05 EUR/m² | - |

| 1 Year | 12.15 EUR/m² | 11.50% | 23.10 EUR/m² | 21.40% |

| 3 Years | 10.85 EUR/m² | 24.80% | 18.60 EUR/m² | 50.80% |

| 5 Years | 10.95 EUR/m² | 23.40% | 15.65 EUR/m² | 79.30% |

ImmoScout24

| Quarter[34] | Berlin Rent/m2 | Germany Rent/m2 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Apartment | House | Apartment | House | |||||||||

| Rent/m2 | Q/Q | Y/Y | Rent/m2 | Q/Q | Y/Y | Rent/m2 | Q/Q | Y/Y | Rent/m2 | Q/Q | Y/Y | |

| Q3 2024 | 12.39 | 2.99% | 5.27% | 15.78 | 0.45% | 4.99% | 8.59 | 1.30% | 4.12% | 10.28 | 3.11% | 7.76% |

| Q2 2024 | 12.03 | 0.50% | 3.08% | 15.71 | 0.51% | 4.18% | 8.48 | 0.83% | 3.79% | 9.97 | 0.71% | 5.73% |

| Q1 2024 | 11.97 | 1.35% | 5.28% | 15.63 | 0.51% | 2.90% | 8.41 | 0.84% | 3.83% | 9.9 | 1.75% | 6.57% |

| Q4 2023 | 11.81 | 0.34% | 7.66% | 15.55 | 3.46% | 2.91% | 8.34 | 1.09% | 4.51% | 9.73 | 1.99% | 5.19% |

| Q3 2023 | 11.77 | 0.86% | 10.10% | 15.03 | -0.33% | 3.09% | 8.25 | 0.98% | 4.96% | 9.54 | 1.17% | 5.07% |

| Q2 2023 | 11.67 | 2.64% | 15.08 | -0.72% | 8.17 | 0.86% | 9.43 | 1.51% | ||||

| Q1 2023 | 11.37 | 3.65% | 15.19 | 0.53% | 8.1 | 1.50% | 9.29 | 0.43% | ||||

| Q4 2022 | 10.97 | 2.62% | 15.11 | 3.64% | 7.98 | 1.53% | 9.25 | 1.87% | ||||

| Q3 2022 | 10.69 | 14.58 | 7.86 | 9.08 | ||||||||

| Q3 2021 | 10.05 | 13.11 | 7.51 | 8.44 | ||||||||

| Q3 2020 | 9.31 | 11.62 | 7.22 | 7.97 | ||||||||

| Q2 2020 | 9.34 | 11.58 | 7.17 | 7.89 | ||||||||

Apartment

| Stadtteil | Q1 2024 Mietpreis (€ / m²) | Q3 2024 |

|---|---|---|

| Friedrichshain-Kreuzberg | 14,83 €/m² | 15,70 €/m² |

| Charlottenburg-Wilmersdorf | 14,35 €/m² | 14,95 €/m² |

| Mitte (Bezirk) | 14,27 €/m² | 14,95 €/m² |

| Steglitz-Zehlendorf | 12,84 €/m² | 13,39 €/m² |

| Tempelhof-Schöneberg | 12,18 €/m² | 12,60 €/m² |

| Pankow (Bezirk) | 12,03 €/m² | 12,69 €/m² |

| Reinickendorf (Bezirk) | 11,69 €/m² | 12,21 €/m² |

| Treptow-Köpenick | 11,46 €/m² | 11,76 €/m² |

| Neukölln (Bezirk) | 11,24 €/m² | 11,79 €/m² |

| Lichtenberg (Bezirk) | 10,90 €/m² | 11,33 €/m² |

| Marzahn-Hellersdorf | 10,83 €/m² | 11,34 €/m² |

| Spandau (Bezirk) | 10,54 €/m² | 10,98 €/m² |

House

| Stadtteil | Q1 2024 Mietpreis (€ / m²) | Q3 2024 |

|---|---|---|

| Steglitz-Zehlendorf | 18,29 €/m² | 18,08 €/m² |

| Friedrichshain-Kreuzberg | 17,98 €/m² | 17,51 €/m² |

| Charlottenburg-Wilmersdorf | 17,70 €/m² | 17,77 €/m² |

| Mitte (Bezirk) | 17,03 €/m² | 16,64 €/m² |

| Tempelhof-Schöneberg | 16,16 €/m² | 16,00 €/m² |

| Pankow (Bezirk) | 15,86 €/m² | 15,78 €/m² |

| Reinickendorf (Bezirk) | 15,58 €/m² | 15,44 €/m² |

| Neukölln (Bezirk) | 15,42 €/m² | 15,30 €/m² |

| Lichtenberg (Bezirk) | 15,08 €/m² | 14,91 €/m² |

| Treptow-Köpenick | 14,95 €/m² | 14,88 €/m² |

| Marzahn-Hellersdorf | 14,93 €/m² | 14,74 €/m² |

| Spandau (Bezirk) | 14,80 €/m² | 14,65 €/m² |

Forecasts

2024

BNP Paribas: The already tight situation on Berlin’s rental housing market has become even tighter. While refugees from Ukraine are creating significant additional demand as they are increasingly looking for housing, fewer units are being completed. This significant excess demand is reflected in the sharp 50 bps decline in the city’s vacancy rate from an already low level to a current 0.3%.

In light of the fact that Berlin remains highly attractive combined with the significantly intensifying housing shortage and the drop in the number of completions, we can expect rent prices to continue their steep rise short to medium term. Condominium purchase prices are expected to stabilise in 2024.[35]

References

- ↑ https://www.merkur.de/wirtschaft/baukrise-branche-wohnungsnot-in-deutschland-wohnungsmarkt-wohnraummangel-vorstoss-kritik-92524673.html

- ↑ https://www.zdf.de/nachrichten/wirtschaft/wohnungsmarkt-mieterbund-100.html

- ↑ https://www.destatis.de/DE/Presse/Pressemitteilungen/2024/07/PD24_278_3111.html

- ↑ https://www.destatis.de/DE/Presse/Pressemitteilungen/2024/02/PD24_074_3111.html#:~:text=11%20000%20Bauantr%C3%A4ge.-,Starke%20R%C3%BCckg%C3%A4nge%20bei%20Ein%2D%20und%20Zweifamilienh%C3%A4usern,300%20Wohnungen)%20besonders%20stark%20zur%C3%BCck.

- ↑ https://www.ifo.de/en/press-release/2024-02-20/european-residential-construction-pushes-sector-red

- ↑ https://www.savills.com/research_articles/255800/355212-0#:~:text=In%20the%20first%20quarter%20of,of%20the%20last%20five%20years.

- ↑ https://www.savills.com/research_articles/255800/355212-0#:~:text=In%20the%20first%20quarter%20of,of%20the%20last%20five%20years.

- ↑ https://www.savills.com/research_articles/255800/355212-0#:~:text=In%20the%20first%20quarter%20of,of%20the%20last%20five%20years.

- ↑ https://www.savills.com/research_articles/255800/295306-0

- ↑ https://www.haufe.de/immobilien/entwicklung-vermarktung/marktanalysen/wohninvestmentmarkt-wenig-portfolio-deals_84324_392508.html

- ↑ https://de.statista.com/statistik/daten/studie/780395/umfrage/anteil-der-bevoelkerung-in-deutschland-mit-zahlungsrueckstaenden-bei-hypotheken-oder-mietzahlungen/#:~:text=Im%20Jahr%202022%20lag%20der,insgesamt%20etwa%202%2C1%20Prozent.

- ↑ https://www.fitchratings.com/research/structured-finance/near-term-risks-from-german-residential-mortgage-resets-are-limited-13-12-2023

- ↑ https://www-genesis.destatis.de/genesis/online?sequenz=tabelleErgebnis&selectionname=61262-0001#abreadcrumb

- ↑ https://www.destatis.de/DE/Presse/Pressemitteilungen/2024/03/PD24_114_61262.html

- ↑ https://report.europace.de/epx-hedonic/

- ↑ https://report.europace.de/alle-news/europace-hauspreisindex-juni-2-2-2-5-2-2-2/

- ↑ https://report.europace.de/alle-news/europace-hauspreisindex-marz-2-2-2-6/

- ↑ https://www.schwaebisch-hall.de/baufinanzierung/kosten/immobilienpreise.html

- ↑ https://www.drklein.de/immobilienpreise.html#:~:text=Die%20Immobilienpreise%20steigen%20seit%20Anfnag,190%2C71%20Indexpunkte%20im%20Februar.

- ↑ https://www.schwaebisch-hall.de/baufinanzierung/kosten/immobilienpreise.html

- ↑ https://www.drklein.de/immobilienpreise.html#:~:text=Die%20Immobilienpreise%20steigen%20seit%20Anfnag,190%2C71%20Indexpunkte%20im%20Februar.

- ↑ https://cijeurope.com/en/prea-predicts-further-price-corrections-in-the-german-housing-markets/post.html

- ↑ https://www.drklein.de/immobilienpreise.html#:~:text=Die%20Immobilienpreise%20steigen%20seit%20Anfnag,190%2C71%20Indexpunkte%20im%20Februar.

- ↑ https://www.drklein.de/immobilienpreise.html#:~:text=Die%20Immobilienpreise%20steigen%20seit%20Anfnag,190%2C71%20Indexpunkte%20im%20Februar.

- ↑ https://www.haufe.de/immobilien/entwicklung-vermarktung/marktanalysen/wohninvestmentmarkt-wenig-portfolio-deals_84324_392508.html

- ↑ https://www.haufe.de/immobilien/entwicklung-vermarktung/marktanalysen/wohninvestmentmarkt-wenig-portfolio-deals_84324_392508.html

- ↑ https://guthmann.estate/en/market-report/berlin/

- ↑ https://guthmann.estate/en/market-report/berlin/apartment-buildings-berlin/

- ↑ https://www.immobilienscout24.de/immobilienpreise/berlin/berlin/hauspreise

- ↑ https://www.immowelt.de/immobilienpreise/berlin/wohnungspreise

- ↑ https://www.immobilienscout24.de/immobilienpreise/berlin/berlin/hauspreise

- ↑ https://www.realestate.bnpparibas.de/sites/default/files/document/2024-03/bnppre-institutional-report-germany-2024.pdf

- ↑ https://guthmann.estate/en/market-report/berlin/

- ↑ https://www.immobilienscout24.de/immobilienpreise/berlin/berlin/mietspiegel

- ↑ https://www.realestate.bnpparibas.de/sites/default/files/document/2024-03/bnppre-institutional-report-germany-2024.pdf