Upwork: Summary of Old Reports/ Conference Calls

Return to: Upwork

Summary

- Approximately one-third of Upwork GSV is generated from clients whose industries are classified by Goldman Sachs as Low Exposure to recession risk. Another one-third come from industries classified as Moderate Exposure while only 1% come from High Exposure classification(Hayden Brown, Q1 2020).

- Approximately 80% of the work in the platform comes from categories considered as essential or somewhat essential(Hayden Brown, Q2 2020).

- Historically disclosed mixed of Upwork GSV is 65% being larger jobs, 20% agency spends, and 15% on gig work(Stifel analyst Logan Thomas, Q3 2020).

- Enterprise plan customers spend on average $1 million per year(Hayden Brown, Q3 2020).

- Every day there’s over 10,000 people who apply to join Upwork as freelancers, but only have jobs for about 2% of them(Stephane Kastriel, Q1 2019).

- In Q2 2019, U.S clients hiring U.S freelancers accounted for 20% of GSV and were growing at 35% y/y. However, their spend retention was declining when compared to U.S clients hiring internationally.

- In Q2 2019, Stephane Kastriel noted that Upwork has extremely low awareness within the traditional buyers of staffing services and that these buyers don’t consider them as alternatives to staffing agencies.

- Each day they get 2,500 buyer sign-ups, half coming from people that sign up using their personal emails or simply people who won’t spend much or contribute much to overall GSV(Stephane Kasriel, Q2 2019).

- Hourly projects have been growing at a faster rate than fixed price projects and the number of hours within those projects has been increasing over time(former CFO Jefff MCcombs, Q4 2021).

- Upwork 100 report found that the average hourly rate for the top 100 skills in Q3 2019 were $43.72, higher than the average hourly rate of 88 percent of U.S workers and all freelancers average hourly rate of $28.

- Upwork saw rapid acceleration in GSV as a result of Covid pandemic.

Investor Day 2021

GSV and client insights

- Between Q4 2018 and Q4 2019, Upwork client spend retention rate was deccelerating. It was flat between Q4 2019 and Q3 2020. But between Q3 2020 and April 2021, it was accelerating[1].

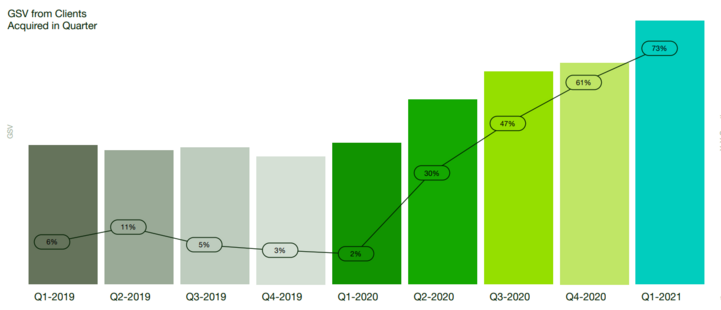

- There was acceleration in GSV among clients acquired each year between 2016 and 2021.

- Between Q1 2020 and Q1 2021, there was acceleration in spend from clients acquired from each quarter.

The Upwork 100 report-Q3 2019

- This report ranked the top 100 skills in Upwork in Q3 2019[2].

- 38% of jobs done by the top 100 skills were being hired by non-U.S companies.

- The top 10 countries for these skills were United States, Canada, United Kingdom, Australia, India, Israel, Germany, Singapore, United Arab Emirates and China in that order.

- The average hourly rate for these top 100 skills were $43.72 in Q3 2019, higher than the average hourly rate of 88 percent of U.S workers.

- In Q3 2019, the average hourly rate for all freelancers was $28.

- The top 10 industries which hired these skills offered by U.S freelancers were Consulting, Internet Software & Services, Internet, Consumer Discretionary, Health Care, Consumer Staples, Publishing, Education, Advertising and Specialized Consumer Services in that order.

Earnings Call Q3 2018

GSV and client insights

- SMBs represented at least 80% of GSV in 2017(MR)[3].

- Upwork has 4 segment of customers: very small businesses or VSBS( <10 employees), Small Businesses(10 to 100 employees), in-market(100 to 1,000 employees), large businesses(above 1,000)(Q&A).

- Stephane Kasriel said that bigger companies tend to be a little bit more risk-averse than smaller companies when hiring freelancers from different countries i.e U.S clients preferred U.S freelancers. "And so what we see is as our business grows faster with bigger companies, we see more and more interest in this type of domestic hiring, " he said(Q&A).

- U.S is their number one geography for clients and freelancers(Q&A).

- Enterprise business growing faster than the overall business but it will take several years before it becomes 50% plus of the business(Q&A).

Competition

- escrow is a big competitive advantage(Q&A). The service is regulated by Department of Business Oversight(DBO), hence they have to make two seperate audits related to their business, which is a big hurdle. Kastriel noted that a freelance company licenced in Australia got "a got a cease-and-desist by the state of California related to the fact that they are not regulated like we are."

Earnings Call Q4 2018

Numbers, Insights, Strategy

- Enterprises today spend an estimated 3.5 trillion on contingent labor. According to Upwork CEO(MR)[4].

GSV and client insights

- A big part of SMB are in IT and are cross-border(Q&A).

- Building enterprise business where a big part are non-IT and domestic hiring-specific(Q&A).

Product

- New integration into Microsoft 365 freelance toolkit (Power BI, Microsoft Teams, SharePoint and Flow) accessible for Upwork Enterprise clients(MR).

- New help me hire feature which allows clients to integrate a coworker/freelancer into the hiring process driver over 10,000 hiring managers sign-ups so far(MR).

- Relaunched mobile freelance ios app and planned launch of mobile freelance android app & client ios and android apps(MR).

Macroeconomic Conditions

- Macro tailwinds. (link to future work 2019 report). Young hiring managers are twice as likely to engage with freelancers(MR).

Earnings Call Q1 2019

Numbers, Insights, Strategy

- The number of Mondays in a quarter affect the amount of revenue[5]. "When there's more Mondays in a quarter we make more money and when comparatively to the previous year or the previous quarter," Kastriel said(MR).

GSV and client insights

- International business growing faster than U.S business(Q&A).

- In the last three years, there has been a shift "from more of the business being cross border to more of the business being domestic."(Q&A)

- 80% of business provided by companies that have less than 100 employees(Q&A).

Freelancer Insights

- Very demand contstraint but very oversupplied in terms of number of freelancers. "Every day there's over 10,000 people who apply to join Upwork as freelancers, and we only have jobs for about 2% of them," Kastriel said(Q&A).

- Over 80% of freelancers have college degree(Q&A).

Earnings Call Q2 2019

Numbers, Insights, Strategy

- There are over 50 companies that spend over a $1 million a year on the platform[6](Q&A).

- Long-term target of 80%-85% gross margin(Q&A).

- A huge part of gross margin growth will come from payment cost(credt card fees) reduction, hence if more clients adopt ACH payment, it helps with leverage(Q&A).

- U.S domestic marketplace is 20% of the business and is growing at 35%(Q&A).

GSV and client insights

- Each day they get 2,500 buyer sign-ups, half coming from people that sign up using their personal emails( people who won't spend much/ contribute much to overall GSV)(Q&A).

- Client spend retention is much higher for enterprise than the overall marketplace, i.e the bigger the company the more the spend retention(Q&A).

- Gig work are projects under $1,000(MR).

- Large projects are projects with over $1,000 and not performed by an agency(MR).

- Vast majority of GSV comes from large projects and agency jobs(MR).

- Gig work is a small portion of their overall GSV and don't believe gig work is the future of their business(Q&A)

Brand marketing

- Have low awareness within the traditional buyers of staffing services. These buyers don't also consider them as alternatives to staffing services(Q&A).

Earnings Call Q3 2019

Numbers, Insights, Strategy

- Managed services is an headwind to take rate when it is growing slower than marketplace. This is because, "revenue recognition policy, managed services is recognized as 100% take rate, whereas the rest of our business is recognized as the net revenue being the take rate," said Kastriel[7].

GSV and client insights

- U.S clients who start with U.S freelancers end up spending more when they start hiring from outside U.S, so they are introducing graduation path where they introduce clients with non-U.S freelancers when their stay in the platform matures(Q&A).

- U.S clients who start by hiring U.S freelancers retains less(Q&A).

Brand Marketing

- Sales team is mainly targeting U.S and Canadian companies(Q&A).

Earnings Call Q4 2019

Numbers, Insights, Strategy

- Persuing $560 million worth of jobs that can be done remotely(MR)[8].

- Hayden believe they can sustain 20%+ y/y growth rate(MR).

- Typical transaction losses range has been 1-2%(MR).

GSV and Clients Insights

- Over 85% of Upwork's GSV was derived from larger engagements and complex projects(MR).

- Demand for Upwork services has always been and continues to be strong among small businesses but the tides are turning in larger company contexts(MR).

- One third of fortune 500 companies are Upwork clients(MR).

- Technical categories account for a substantial portion of Upwork GSV(MR).

- Main focus is to improve client spend retention rate(Q&A).

Management and Culture

- After taking up CEO position, she made significant organizational changes(MR).

- Hayden said, "within Upwork, I am known for bold leadership, a long-term strategic focus, and my deep passion for our mission and our business."(MR)

- Hayden Brown came up with new strategy upon becoming CEO: "number one, attract more, bigger clients; number two, enable more spend per client; and number three, make more high-quality matches, particularly in our technical categories of web, mobile, and software development."(MR)

- Hayden Brown said she speaks with both large and small clients everyday.(MR)

- Its Customer Advisory Board is made up of representatives from its biggest clients(Q&A).

Brand Marketing

- It takes about 6 months for a new rep to ramp to full productivity(MR).

- Launched brand campaign which targets staffing clients(MR).

Earnings Call Q1 2020

Numbers, Insights, Strategy

- Gartner CFO study found that 74% of companies plan to shift to more remote work after the pandemic(MR)[9].

- Citrix poll found that 28% who started working remotely plans to seek remote jobs after the pandemic(MR).

- Q1 revenue was reduced by approximately 1% by Covid(MR).

- The company withdrew annual guidance due to unpredictability of macro environment as a result of Covid but provided guidance for the second quarter(MR).

- Accelerated hourly contract payments of top rated freelancers by 50%(MR).

- Some of the big themes they saw were around IT, marketing and content and customer support(Q&A).

- Anticipate that dynamic and flexible working will be the rule going forward(Q&A).

GSV and Clients Insights

- GSV from small and mid-sized clients decreased 3% starting in March 9 and lasting through early April, compared to the average levels seen earlier in the quarter(MR).

- Approximately one-third of Upwork GSV is generated from clients whose industries are classified by Goldman Sachs as Low Exposure to recession risk. Another one-third of its clients come from industries classified as Moderate Exposure while only 1% come from High Exposure classification(MR).

- Approximately half of GSV comes from categories of work that are Essential to its clients while one-third come from categories that are Somewhat Essential(MR).

- Pandemic started to impact the platform in the second week of March(MR).

- The platform saw rebound in orders in the fourth week of March(MR).

- Many prospective clients have either never heard of Upwork or believe Upwork is a site for small gigs(MR).

- Saw softness in Q1 as a result of "the pandemic's immediate impact on larger companies' general willingness to sign new contracts."(MR)

- Some businesses moved their staff to Upwork to take advantage of its tools(MR).

- Saw uptick in GSV from mid-market and larger customers(Q&A).

Product

- Launched direct contracts(MR).

- Lauched Work Together Talent Grants program, which offers grants of $1 million to clients that hire Upwork freelancers to work on Covid-related projects(MR).

Employees

- Had approximately 2,000 team members(MR).

- Paused sales team hiring(MR).

Brand Marketing

- Saw 70% increase in brand awareness among the targeted buyers(MR).

Freelancer Insights

- Saw an influx of new freelancers(MR).

- Upwork does not only provide freelancers and IC compliance, but also has employer of record and payrolling solution(Q&A).

Earnings Call Q2 2020

Numbers, Insights, Strategy

- Anticipating the economy to get worse in Q3 due to 30 million unemployed Americans, stimulus programs largely dried up and no forthcoming from small businesses(Q&A)[10].

- 20% or 30% of CFOs believe remote work will be part of a number of jobs going forward(Q&A).

- Seismic trends towards remote and flexible work continue to work in Upwork's favor as illustrated in their Fourth Annual Future Workforce report.(MR)

GSV and Clients Insights

- Spend from new clients was the largest contributor to GSV as they onboarded a record number of them(MR).

- GSV was also supported by retained clients. Upwork onboarded 4,000 of them to its core client roaster(MR).

- Some clients pulled back spend due to macro economic factors(MR).

- Began to exceed "pre-crisis levels on numerous top line activity metrics such as client registrations and new job post in early to mid April."(MR)

- Entered into partnership with Citrix and that grants them opportunity to land its clients(Q&A).

- Product sizes holds steady but seeing a shift in favor of high value work(Q&A).

- Approximately 80% of the work in the platform comes from categories conisdered as essential or somewhat essential(Q&A).

- The premium for having workers from the Top 15 most expensive cities in U.S is 40% compared to other geographies(Q&A).

- More than 50% of hiring managers feel the shift to remote work has gone better-than-expected(Q&A).

- Matching of talent with clients is based on talen's profile and how their matching algorithms consume and process profile information(Q&A).

Product

- Debuted Upwork Expert-Vetted Talent(MR).

- Increased search speed results by 10%(Q&A).

- Expanded the availability of employer of record to all customers(MR).

Management and Culture

- CFO Brian Kinion seems to have been fired. [11] "I think there's little concern about the transition and maybe just talk through this, from your perspective, that'd be helpful?" Brent Thill from Jefferies asked. "I haven't decided what's next. I'm going to take some time over with my families. And I'll be very good and happy Upwork shareholder as well, " Kinion responded. "I think Brian's been an incredible partner and I think we've been having a lot of conversations since I stepped into the CEO role about the direction of the Company and our focus right now on really driving strategic growth priorities. And I'm excited that Jeff is really bringing in a strategic lens to financial leadership," Hayden Brown added(Q&A).

Freelancer Insights

- Saw a huge global demand for technical talent(MR).

Brand Marketing

- Used cost-savings from shift to remote work to drive brand awareness(Q&A).

Earnings Call Q3 2020

Numbers, Insights, Strategy

- Revenue of $97 million(+24% y/y) exceeded the high end of their guidance[12](MR).

- Hayden Brown quoted an Harvard Business Review article titled, " Rethinking the On-Demand Workforce."(MR)

- 90% of the executives they surveyed believe the platform will be key to their ability to compete in future.(MR)

- Management was bullish on their business(MR).

GSV and Clients Insights

- GSV "grew 23% year-over-year and accelerated quarter-over-quarter due to a continued secular shift toward remote and independent work, coupled with strong execution by our team against our growth strategy."(MR)

- GSV driven by both existing clients and new clients(Q&A).

- U.S and international client registrations grew at record levels. Saw an 89% yy increase in client registrations from the SEO channel(Q&A).

- Enterprise plan customers spend on average $1 million per year(MR).

- Impact of macroeconomic conditions on small businesses was less than anticipated(MR).

- According to Stifel Analyst, historically disclosed mixed of Upwork GSV is 65% being larger jobs, 20% agency spends, and 15% on gig work(Q&A).

- Strength seen in the quarter was broadbased but the main categories that showed strength were web mobile software development, sales marketing, design and creative(Q&A).

- Seeing interest from customers on things like Expert-Vetted program and top rated status(Q&A).

- Zendesk(client with 4,000 employees) leveraging Upwork with teams from accounting and administrative support to engineering and software development(MR).

Product

- Bring Your Own(BYO) talent grew 37% y/y in Q3(MR).

- Launched project catalog in beta version(MR).

- Project catalog is a great way for clients to get a taste of the platform(Q&A).

Brand Marketing

- Will reduce sales team by approximately one-third.

- Sales team is a split of hunthers and gatherers(Q&A).

Freelancer Insights

- Approximately two-third of Upwork internal talent are freelancers(MR).

Earnings Call Q4 2020

Numbers, Insights, Strategy

- Q4 revenue grew 32% y/y to $106 million, the best growth y/y since going public(MR).

- Increase in addressable market opportunity to more than $1 trillion(MR).

- Seing openness across spectrum to hire freelancers(MR).

GSV and Clients Insights

- Clients acquired in Q4 spent 10% more per client than clients acquired in Q4 2019(MR).

- Upwork typically experiences slowdown started from November and peaking in the last two weeks of December, but was not existent this year probably due to Covid restrictions "reducing holiday travel and social gatherings and increasing the amount of work that was being done during this period relative to prior years."(MR)

- Bullish on GSV growth opportunities(MR).

- Client spend is broad-based across all cohorts(Q&A).

- Landed a global tech firm that onboarded 1,000 freelancers "running over $1 million through this BYOT product all within Q4."(MR)

Product

- Expanded direct contracts to include hourly jobs(MR).

- Launche project catalog across 300 marketplaces one month earlier than planned(MR).

- Bring your own talent has seen 400% growth since inception(MR).

- Reception of project catalog has been positive(MR).

- Launched integrated onboarding process that reduced start time on payroll contracts from 9 days to 2.5 days(MR).

- Partnered with Zoom to integrate Zoom videos and communication tools into Upwork(MR).

- Project catalog will push up take rate as majority of the contracts are in the higher-tiers(Q&A).

Freelancer Insights

- Influx of talent over the last year continues to be strong(Q&A).

Competition

- Hayden Brown indirectly points to Fiverr as its largest competitor, but points out that it outnumbers it when it comes to GSV, revenue and number of talents(Q&A).

- Brown notes that Upwork has certain features that differentiate it from competitors eg being a platform of both small and large projects and having built trust with clients and freelancers for a very long time.

Earnings Call Q1 2021

Numbers, Insights, Strategy

- Revenue grew 37% y/y to $114 million while GSV grew 41% y/y to $787 million, marking the third consequtive quarter of acceleration(MR)[13].

- Started calling the platform the work marketplace(MR).

- Pandemic changed the work forever, accelerating adoption of freelancers not just to perform traditional freelance jobs but also high level jobs(MR).

- Meaningfully lowered cost per acquisition(MR).

- Number of active freelancers grew significantly during the quarter(MR).

- Bullish about investment opportunities in front of them(MR).

- Every cohort eg client retention rate(from 102% to 106%) has accelerated y/y(Q&A).

- Work marketplace is aimed at defining Upwork category and raising awareness about the breadth of the platform. It's not about shifting their strategy(Q&A).

- Every job category is growing(Q&A).

Product

- Too early to give feedback on performance of project catalog but they have noticed that it's additive to the market place(Q&A).

Brand Campaign

- Brand awareness focus is on U.S market but also doing some advertising in English speaking international markets(Q&A).

GSV and Clients Insights

- Grew new clients by 55%, marking fourth consequtive growth acceleration(MR).

- SEM-acquired new clients increased by 113% q/q in Q1(MR)

- Grew core clients by 7,000 or 61% y/y(MR).

- Enterprise clients grew 40% q/q, strongest quarter ever(MR).

- Client retention has been historically above 100%, which gives them visibility on how the future will perform(Q&A).

Earnings Call Q2 2021

Numbers, Insights, Strategy

- Revenue grew by 42% y/y[14]. (MR)

- Single strategic priority remains to be innovating, scaling and promoting the work marketplace. (MR)

GSV and Clients Insights

- GSV grew by 50% y/y, driven by what they believe to be permanent changes to how work is done(MR).

- Raised addressable market from $1 trillion to $1.3 trillion(MR).

- It's still early to see if Project Catalog is having an impact on GSV but generally, the impact is expected to be positive(Q&A).

- A lot of the jobs posted by enterprise clients are in design and creative category(Q&A).

- Slowdown in GSV growth normally happens at the beginning of Q1 also as people take time to resume work after the holoday(Q&A).

- They are seeing a slight drop in GSV from Q2 to Q3 as clients and vacations and summer travel.That has been a seaonal trend since 2018. (Q&A)

- 10% of new customers are coming in through project catalog(Q&A).

Product

- Project Catalog customers are not just buying catalogs but also cross-buying other main products in the marketplace.(Q&A)

Marketing

- Launched Talent Scout, which is less expensive compared to traditional staffing agencies.(MR)

- Having positive impacts from brand campaigns. (Q&A)

Earnings Call Q3 2021

Numbers, Insights, Strategy

- 10 million Americans considering leaving their full-time jobs in an attempt to gain flexibility(MR)[15].

- Organizations are realizing that full-time roles will be left behind(MR).

- Hayden said the war for talent(labor shortage) is a tailwind to Upwork. But the shortage was there before Covid and during Covid. So it's not something new to the platform(Q&A).

GSV and Clients Insights

- GSV rose 38% y/y to 904 million(MR).

- Leading lodging company superpassed $10 million in spend within the first year of being Upwork's customer(MR).

- Customers who spent $1 million or more in the trailing 12 months up 11% q/q(MR).

- The huge spend by client that spend $10 million within the first year has nothing to do with the services the company is offering but great execution by the land team(Q&A).

Product

- Introduced talent virtual bench, a collection of tools to aid client-talent relationship(MR).

- Thinking about launching boosted proposals tool(Q&A).

- Also working on availability badges(Q&A).

- Seeing great progress with talent scout. Reduced time to deliver by 30%(Q&A).

Employees

- Ratio of independent talent to employees is 2:1(MR).

- Has 2,000 employess distributed in more than 80 countries.

Brand Campaign

- Hayden said Upwork has single-digit brand awareness, meaning most companies are still not aware of what it does(Q&A).

- Will double brand awareness spend in Q4(Q&A).

- Will expand the enterprise sales team in 2022(Q&A).

- Brand awareness spend is a multi-quarter, potentially multi-year type of investment(Q&A).

- Brand spend is not like performance spend, it doesn't provide immediate in-quarter return(Q&A).

Remote Work

- Don't expect return to office to affect the demand for its talent(Q&A).

Earnings Call Q4 2021

Numbers, Insights, Strategy

- Surpassed $15 billion in lifetime talent earnings on Upwork(MR)[16].

- Their CAGR rate target is 25% for the next three years(MR).

- Categories like accounting and consulting grew 72% y/y(Q&A).

- Believe Upwork can deliver 30% to 35% long-term EBITDA margins(Q&A).

- Take rate in 2022 will be hire than in 2021 driven by "a number of dynamics a few initiatives that we're working on including growth in Project Catalog or Talent Scout Enterprise which all three of those have higher take rates than the rest of the business."(Q&A)

- Average spend per client increased by 15%, still in the 4,000 range(Q&A).

- Dynamics and trends in the business "weren't meaningfully driven by the surge in Omicron."(Q&A).

GSV and Clients Insights

- Lowered the time they expect to achieve $1 billion in revenue from 2025 to 2024(MR).

- They are setting an enterprise revenue target of $300 million by 2025, 10x what they delivered in 2021(MR).

- Seeing growth in all categories as companies struggle with talent shortage(Q&A).

- Clients spending over $100,000 per year grew 51% y/y(Q&A).

- $1 million spenders grew 61% y/y(Q&A).

- "Hourly projects have been growing at a faster rate than fixed price projects and the number of hours within those projects has been increasing over time," Said CFO Jefff MCcombs(Q&A).

- Increase in hourly rates has been relatively consistent over the last several years(Q&A).

- But growth in the business is expected to come from both, increased in the number of jobs and average spend per client(Q&A).

- Seasonality(eg Covid) not playing out in enterprise business growth(Q&A).

Product

- Every quarter they have seen increase in the number of customers who come in through Project Catalog(Q&A).

- Still early days to showcase the impact of boosted proposals and availability badges(Q&A).

Brand Campaign

- Launched the perfect fit brand campaign awareness during the quarter(MR).

- It is a favarable environment to be making brand investments(Q&A).

- Signal metrics they are looking in brand investment include traffic, client registrations, pre-rental registrations, and branded search queries(Q&A).

- Spent $47 million in brand marketing in 2021 and will spend $80 million in 2022(Q&A).

Freelancer Insights

- Talent dynamics is not slowing down. Weges is strong(Q&A).

Competition

- Don't hear anything about competitors such as LinkedIn from clients(Q&A).

- "Upwork talent quality is more superior than that of staffing agencies," said Hayden(Q&A).

- Upwork attractive than staffing agencies who have steep markups and this resonates well with clients(Q&A).

Definitions

MR: Stands for management remarks.

Q&A: Stands for questions and answers.

References

- ↑ https://investors.upwork.com/static-files/11fe6ce1-8c50-40e5-9f4e-2710de4e27c8

- ↑ https://www.upwork.com/press/releases/the-upwork-100-q3-2019

- ↑ https://capedge.com/transcript/1627475/2018Q3/UPWK

- ↑ https://capedge.com/transcript/1627475/2018Q4/UPWK

- ↑ https://capedge.com/transcript/1627475/2019Q1/UPWK

- ↑ https://capedge.com/transcript/1627475/2019Q2/UPWK

- ↑ https://capedge.com/transcript/1627475/2019Q3/UPWK

- ↑ https://capedge.com/transcript/1627475/2019Q4/UPWK

- ↑ https://capedge.com/transcript/1627475/2020Q1/UPWK

- ↑ https://capedge.com/transcript/1627475/2020Q2/UPWK

- ↑ https://www.linkedin.com/in/briankinion/

- ↑ https://capedge.com/transcript/1627475/2020Q3/UPWK

- ↑ https://capedge.com/transcript/1627475/2021Q1/UPWK

- ↑ https://capedge.com/transcript/1627475/2021Q2/UPWK

- ↑ https://capedge.com/transcript/1627475/2021Q3/UPWK

- ↑ https://capedge.com/transcript/1627475/2021Q4/UPWK