Earnings Overview: 2023 Q3

See also: Earnings Overview: 2023 Q2 | S&P 500 Earnings Overview | : Earnings Overview: 2023 Q4

Actual Results

Refinitiv

| [1] | 21Q2 | 21Q3 | 21Q4 | 22Q1 | 22Q2 | 22Q3 | 22Q4 | 23Q1 | 23Q2 | 23Q3E | 23Q4E | 24Q1E | 24Q2E | 24Q3E | 24Q4E | 25Q1E | 25Q2E | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 25.2% | 17.0% | 15.1% | 14.0% | 13.6% | 11.7% | 5.8% | 3.6% | 0.5% | 1.7% | 2.6% | 4.1% | 5.0% | 5.0% | 5.7% | 5.5% | 5.3% | |||||||

| Net Income | 94.8% | 42.1% | 30.1% | 9.6% | 5.9% | 2.6% | -6.1% | -2.8% | -5.4% | 4.4% | 2.6% | 5.6% | 10.5% | 7.4% | 17.7% | 12.4% | 11.4% | |||||||

| Earnings | 96.3% | 42.6% | 32.1% | 11.4% | 8.4% | 4.4% | -3.2% | 0.1% | -2.8% | 7.5% | 5.2% | 7.4% | 11.4% | 8.4% | 17.8% | 13.5% | 12.9% | |||||||

Current/Future Share-Weighted Earnings ($B's )

| Sector | 2023Q3 | 2023Q4 | 2024Q1 | 2024Q2 | 2023 | 2024 | ||

|---|---|---|---|---|---|---|---|---|

| Consumer Discretionary | 47.03 | 34.82 | 34.49 | 44.14 | 152.5 | 170.2 | ||

| Consumer Staples | 31.65 | 28.95 | 30.01 | 32.40 | 119.1 | 128.7 | ||

| Energy | 36.75 | 33.35 | 34.30 | 35.85 | 140.5 | 142.8 | ||

| Financials | 88.56 | 79.92 | 87.10 | 86.80 | 333.6 | 354.6 | ||

| Health Care | 60.90 | 54.66 | 67.91 | 70.25 | 240.3 | 282.3 | ||

| Industrials | 40.68 | 38.14 | 37.58 | 45.99 | 158.0 | 177.4 | ||

| Materials | 11.39 | 9.67 | 11.39 | 13.91 | 48.1 | 49.8 | ||

| Real Estate | 11.41 | 11.43 | 11.42 | 11.85 | 45.8 | 47.6 | ||

| Technology | 97.29 | 106.66 | 97.85 | 99.22 | 372.8 | 432.4 | ||

| Communication Services | 47.39 | 46.40 | 44.10 | 49.05 | 171.1 | 198.3 | ||

| Utilities | 16.99 | 13.23 | 14.83 | 12.48 | 54.7 | 58.0 | ||

| S&P 500 | 490.04 | 457.22 | 470.98 | 501.95 | 1,836.6 | 2,042.1 | ||

Current/Future Revenue ($B'S )

| Sector | 2023Q3 | 2023Q4 | 2024Q1 | 2024Q2 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|

| Consumer Discretionary | 479.2 | 491.3 | 462.0 | 502.1 | 1,771.8 | 2,008.4 | |

| Consumer Staples | 463.5 | 465.1 | 449.1 | 454.2 | 1,695.8 | 1,864.2 | |

| Energy | 341.4 | 331.9 | 325.6 | 334.8 | 1,227.4 | 1,320.3 | |

| Financials | 466.6 | 453.1 | 465.1 | 469.9 | 1,703.4 | 1,893.2 | |

| Health Care | 752.6 | 754.0 | 768.0 | 789.5 | 2,814.2 | 3,166.3 | |

| Industrials | 401.7 | 403.6 | 394.7 | 419.1 | 1,493.8 | 1,671.0 | |

| Materials | 111.8 | 108.8 | 113.1 | 119.5 | 427.5 | 462.7 | |

| Real Estate | 37.9 | 38.7 | 38.7 | 39.7 | 141.0 | 159.3 | |

| Technology | 383.2 | 422.6 | 400.6 | 403.6 | 1,451.8 | 1,692.6 | |

| Communication Services | 271.2 | 289.3 | 273.1 | 282.1 | 1,019.8 | 1,152.0 | |

| Utilities | 106.8 | 110.7 | 99.8 | 85.6 | 398.3 | 430.4 | |

| S&P 500 | 3,816.1 | 3,869.0 | 3,789.7 | 3,900.1 | 14,144.8 | 15,820.6 | |

Estimates

Refinitiv

S&P 500 YoY Growth Rates

| 21Q2 | 21Q3 | 21Q4 | 22Q1 | 22Q2 | 22Q3 | 22Q4 | 23Q1 | 23Q2 | 23Q3E | 23Q4E | 24Q1E | 24Q2E | 24Q3E | 24Q4E | 25Q1E | 25Q2E | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 25.2% | 17.0% | 15.1% | 14.0% | 13.6% | 11.7% | 5.8% | 3.6% | 0.5% | 0.9% | 3.6% | 4.4% | 5.1% | 5.5% | 5.1% | 5.8% | 5.8% | |||||||

| Net Income | 94.8% | 42.1% | 30.1% | 9.6% | 5.9% | 2.6% | -6.1% | -2.8% | -5.4% | -1.8% | 8.8% | 7.7% | 11.8% | 12.8% | 12.6% | 11.9% | 11.5% | |||||||

| Earnings | 96.3% | 42.6% | 32.1% | 11.4% | 8.4% | 4.4% | -3.2% | 0.1% | -2.8% | 1.3% | 10.8% | 9.1% | 12.4% | 13.3% | 13.3% | 14.0% | 14.0% | |||||||

- The 23Q3 Y/Y blended earnings growth estimate is 1.3%. If the energy sector is excluded, the growth rate for the index is 6.2%.[2]

- Of the 20 companies in the S&P 500 that have reported earnings as of octubre 6 for 23Q3, 85.0% reported above analyst expectations. This compares to a long-term average of 66%.

- The 23Q3 Y/Y blended revenue growth estimate is 0.9%. If the energy sector is excluded, the growth rate for the index is 3.3%.

2023Q3 Blended (Reported & Estimated) Earnings Growth

| Earnings Growth | Current/Future Share-Weighted Earnings ($B's ) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | 6 Oct | 1 Oct | 1 Jul | 1 Apr | 1 Jan | 1 Oct | 2023Q3 | 2023Q4 | 2024Q1 | 2024Q2 | 2023 | 2024 |

| Consumer Discretionary | 23.1% | 23.0% | 13.4% | 13.2% | 20.7% | 27.1% | 40.54 | 36.05 | 34.38 | 44.01 | 147.2 | 169.2 |

| Consumer Staples | 1.2% | 1.3% | 5.5% | 8.9% | 7.2% | 9.4% | 29.74 | 29.79 | 30.85 | 32.98 | 118.4 | 130.7 |

| Energy | -34.7% | -35.0% | -38.1% | -29.0% | -23.8% | -16.8% | 36.23 | 35.96 | 35.04 | 36.85 | 143.0 | 146.7 |

| Financials | 11.3% | 11.9% | 14.5% | 17.0% | 21.4% | 15.3% | 80.73 | 82.65 | 88.40 | 87.60 | 330.5 | 357.7 |

| Health Care | -10.0% | -9.7% | -6.5% | -5.2% | -2.3% | 5.8% | 66.73 | 69.21 | 71.47 | 72.18 | 261.5 | 294.9 |

| Industrials | 5.3% | 8.6% | 15.1% | 14.5% | 15.7% | 12.9% | 37.82 | 39.88 | 38.30 | 46.43 | 156.3 | 177.9 |

| Materials | -20.5% | -20.5% | -8.7% | -2.2% | -1.8% | -2.4% | 11.15 | 11.24 | 12.37 | 14.73 | 49.6 | 52.2 |

| Real Estate | -7.3% | -7.1% | -5.9% | -8.3% | -3.2% | 4.3% | 11.14 | 11.68 | 11.46 | 11.98 | 45.7 | 48.3 |

| Technology | 6.0% | 5.9% | 1.3% | 1.2% | 5.1% | 14.7% | 89.00 | 104.71 | 97.55 | 98.59 | 362.2 | 425.4 |

| Communication Services | 33.8% | 34.0% | 28.1% | 23.4% | 20.1% | 16.8% | 44.27 | 48.87 | 45.96 | 50.45 | 171.6 | 202.8 |

| Utilities | 12.5% | 12.4% | 13.5% | 10.5% | 10.0% | 6.2% | 17.27 | 13.69 | 14.75 | 12.92 | 54.5 | 58.2 |

| S&P 500 | 1.3% | 1.6% | 1.3% | 2.8% | 5.5% | 9.5% | 464.61 | 483.73 | 480.54 | 508.72 | 1,840.5 | 2,063.8 |

2023Q3 Blended (Reported & Estimated) Revenue Growth

| Revenue Growth | Current/Future Revenue ($B'S ) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | Oct 6 | 1 Oct | 1 Jul | 1 Apr | 1 Jan | 1 Oct | 2023Q3 | 2023Q4 | 2024Q1 | 2024Q2 | 2023 | 2024 | |

| Consumer Discretionary | 6.3% | 6.4% | 4.7% | 4.3% | 5.3% | 9.4% | 474.2 | 499.7 | 464.6 | 503.9 | 1,769.1 | 2,016.7 | |

| Consumer Staples | 3.7% | 3.9% | 4.1% | 4.3% | 4.1% | 4.1% | 462.4 | 469.2 | 450.7 | 456.4 | 1,700.3 | 1,872.2 | |

| Energy | -18.8% | -19.6% | -19.9% | -18.0% | -15.7% | -6.7% | 333.9 | 338.3 | 328.5 | 333.9 | 1,222.4 | 1,295.7 | |

| Financials | 2.3% | 2.4% | 2.1% | 4.4% | 1.9% | 6.8% | 455.6 | 455.4 | 466.7 | 471.2 | 1,711.4 | 1,900.3 | |

| Health Care | 5.0% | 5.1% | 4.4% | 3.6% | 3.3% | 4.3% | 742.6 | 763.4 | 767.1 | 785.0 | 2,816.0 | 3,149.9 | |

| Industrials | 1.6% | 1.8% | 2.5% | 2.5% | 3.3% | 4.7% | 385.3 | 394.9 | 384.8 | 392.4 | 1,447.6 | 1,627.3 | |

| Materials | -9.6% | -9.9% | -2.7% | 0.0% | -1.8% | -0.3% | 113.9 | 113.3 | 116.8 | 123.5 | 437.5 | 454.1 | |

| Real Estate | 6.6% | 6.9% | 6.4% | 6.8% | 6.0% | 7.6% | 37.3 | 38.8 | 38.5 | 39.3 | 140.7 | 158.8 | |

| Technology | 1.5% | 1.4% | 1.2% | 2.0% | 4.4% | 8.3% | 370.6 | 417.4 | 394.3 | 395.8 | 1,423.0 | 1,663.3 | |

| Communication Services | 5.2% | 5.2% | 4.4% | 4.5% | 4.8% | 6.9% | 271.1 | 293.7 | 275.4 | 283.9 | 1,027.7 | 1,161.9 | |

| Utilities | 3.7% | 3.6% | 1.5% | -2.3% | -6.0% | -1.5% | 114.2 | 103.8 | 93.3 | 75.7 | 404.0 | 437.8 | |

| S&P 500 | 0.9% | 0.8% | 0.6% | 1.0% | 1.2% | 4.4% | 3,761.0 | 3,887.8 | 3,780.6 | 3,861.0 | 14,099.6 | 15,738.0 | |

Factset

- Earnings Decline: For Q3 2023, the estimated (year-over-year) earnings decline for the S&P 500 is -0.1%. If -0.1% is the actual decline for the quarter, it will mark the fourth straight quarter of (year-over-year) earnings declines reported by the index. [3]

- Earnings Revisions: On June 30, the estimated (year-over-year) earnings decline for the S&P 500 for Q3 2023 was -0.4%. Four sectors are expected to report higher earnings today (compared to June 30) due to upward revisions to EPS estimates.

- Earnings Guidance: For Q3 2023, 74 S&P 500 companies have issued negative EPS guidance and 42 S&P 500 companies have issued positive EPS guidance.

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.9. This P/E ratio is below the 5-year average (18.7) but above the 10-year average (17.5).

Earnings Growth

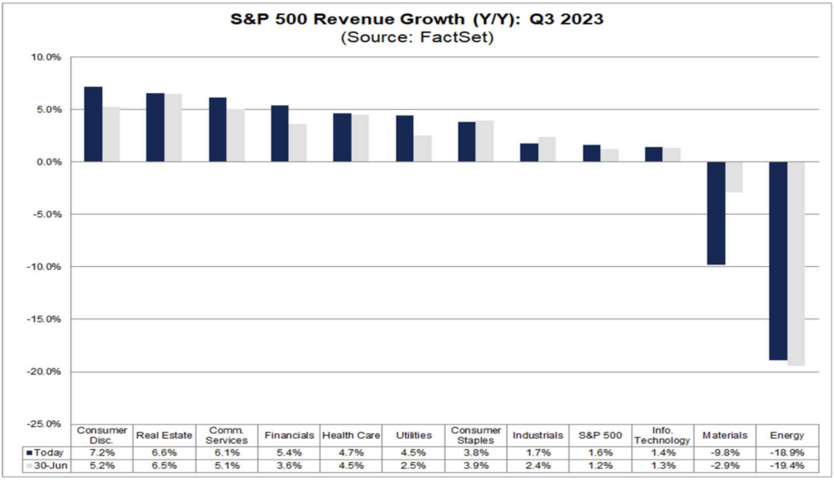

Revenue Growth

References

- ↑ https://lipperalpha.refinitiv.com/wp-content/uploads/2023/12/TRPR_82201_20231222.pdf

- ↑ https://lipperalpha.refinitiv.com/wp-content/uploads/2023/10/TRPR_82201_20231006.pdf

- ↑ https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_092923.pdf?_gl=1*1xzdq4k*_ga*MjEwNjczNzk3NS4xNjkzODU1ODM1*_ga_2Q3PTT96M8*MTY5Njg3MzkxNC4zLjEuMTY5Njg3NDUzNy4wLjAuMA..